“The strong performance in the second quarter of 2010 was partly due to a weak second quarter of 2009. For a better comparison, the PC market in Western Europe grew 6 percent compared with the second quarter of 2008, indicating not only a recovery but good underlying market strength. Economic concerns in several southern European countries (Spain, Portugal, Italy and Greece) created uncertainty in the PC market and caused more volatility in the second quarter of 2010, rather than softening overall demand,” said Mr. Atwal.

The consumer market continued to perform significantly above the professional segment, driven by consumer notebooks and expanding sales of all-in-one desktop PCs. Demand for mini-notebooks slowed down, especially in Western Europe. For the first time, mini-notebook growth reached less than 10 percent, below the growth rate of standard mobile PCs. However, the mini-notebook market has established a strong position in the market and represented 19 percent of all mobile PC sales in Western Europe.

The improvement in demand from the professional market was relatively modest in the second quarter. The professional market has been affected by the economic conditions and unit price increases, causing some PC purchases to be delayed.

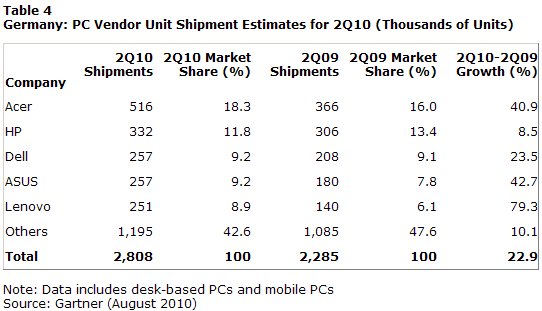

In the second quarter of 2010, Acer moved to the No. 1 position in Western Europe (see Table 1) as a result of strong growth in consumer PCs. ASUS and vendors outside the top five experienced strong growth, with Apple, Sony, Samsung and Lenovo all growing above 30 percent in the second quarter.

“Despite the increased economic concerns, the Western European PC market is the most competitive we have seen for many years,” said Mr. Atwal. “It is now a market influenced by the top 10, and not just by the top five vendors.”

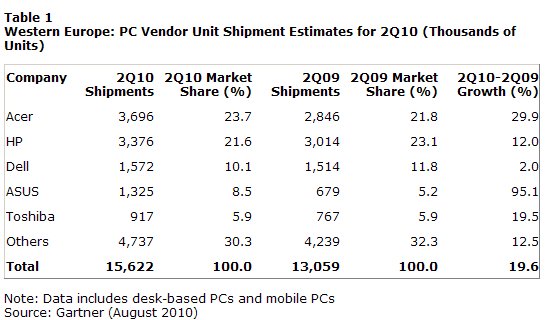

The U.K. Remained the Weakest of the Larger Markets in Western Europe

PC shipments in the U.K. totaled 2.9 million units in the second quarter of 2010, a 15.1 percent increase compared with the same period in 2009 (see Table 2).

“The U.K. market remained the weakest of the larger PC markets in Western Europe with growth almost half that of France. Given the U.K. market was also the weakest in the downturn, its recovery had been much more muted,” said Mr. Atwal.

In the second quarter, the mobile PC market grew 17 percent, with consumer PCs leading the way with more than 30 percent growth compared to low double-digit professional mobile growth. This trend was repeated for desk-based PCs. All-in-one consumer PC sales grew in double-digits while professional desk–based PCs saw only single-digit growth, despite a very weak second quarter of 2009. This indicates the recovery of the professional market is being delayed.

“There is no doubt that the introduction of the austerity measures in the U.K. has hindered any anticipated improvement in the underlying demand for PCs,” said Mr. Atwal. “We don’t expect this to change for the rest of 2010. As businesses and consumers come to terms with the potential impact of the government measures, caution is certainly the keyword across all IT markets and the PC market is currently no different.”

Dell felt the full impact of the U.K.’s market weakness, shrinking more than 20 percent year-on-year. Dell was affected on the professional side and was unable to capture retail shelf space, as the PC channel squeezed overall volumes in reaction to a weaker market. Acer and HP's respective performance was more than twice the average market growth as they dominated the consumer market with a combined share of almost 45 percent. “In many ways, the remaining vendors only have half the consumer market to target, and in a weak market that is a tough proposition,” added Mr. Atwal.

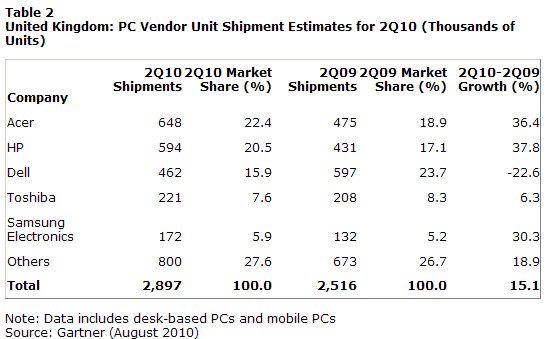

France: Ranked No. 2 in EMEA for the First Time

PC shipments in France totaled 2.8 million units in the second quarter of 2010, an increase of 28.9 percent compared with the same period in 2009 (see Table 3).

“Despite growing concern about unfavorable exchange rates, the PC market in France performed above expectations, but we need to recognize that this was growth from a low base last year. This quarter’s strong performance helped France become the No. 2 market in EMEA in terms of PC shipments, where it previously held the No. 3 position,” said Isabelle Durand, principal analyst at Gartner.

In the second quarter of 2010, the mobile PC market accounted for 67 percent of total PC shipments in France, with volumes increasing 37 percent. Desk-based PCs recovered with growth of 15 percent year-on-year. “The growth in desktop PCs can be mainly attributed to high demand for all-in-one desktop models from Apple and HP. All-in-one PC represented 10 percent of all desk-based shipments in the second quarter of 2010,” added Ms. Durand.

The consumer PC market continued to exhibit strong growth, with an increase of 39 percent year-on-year. The professional PC market was driven by spending on replacement PCs and Windows 7 migrations, and achieved 15 percent growth in the second quarter of 2010. The consumer PC market continued to be driven by mainstream notebooks but also saw a resurgence in demand for consumer desktops, which grew by 26 percent in the second quarter of 2010. Mini-notebooks retained a 25 percent share of all mobile PCs shipped in France.

In the second quarter of 2010, HP regained the No. 1 position from Acer, while Acer grew less than the market average. ASUS was the fastest-growing PC vendor of the top five in France, and as a result moved up to third place. ASUS continued to use mini-notebooks as a vehicle for growth, and sales of mini-notebooks represented 35 percent of its PC shipments. “Dell’s strategy for improving business demand and enhancing its presence in the retail market was not sufficient to retain the No. 3 position in France,” said Ms. Durand.

Gartner analysts expect PC demand will continue to increase during the second half of 2010. “Nevertheless, shipment growth is likely to be lower than in the second quarter of 2010 as vendors have already postponed some orders to reduce costs, and high inventory levels could impact the market,” said Ms. Durand.

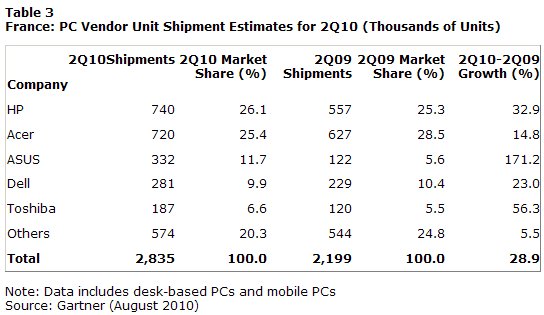

Germany: PC Shipments Continued to Exhibit Double-Digit Growth

PC shipments in Germany totaled 2.8 million units in the second quarter of 2010, an increase of 22.9 percent compared with the same period in 2009 (see Table 4).

“Although the growth is based on a weak second quarter in 2009, compared to the second quarter of 2008 we are looking at an increase of 18 percent, which definitely points to a return to normal demand patterns,” said Meike Escherich, principal research analyst at Gartner.

Mobile PC shipments in Germany increased 30 percent in the second quarter of 2010. Mainstream notebooks grew 35 percent year-on-year, while desktop PCs increased 11 percent. Most of the growth in the desktop PC market was generated by strong demand for mini-PCs and the new all-in-one category. Mini-notebooks declined 7 percent, losing out to slightly larger, but still inexpensive, ultraportables from vendors like ASUS and Acer.

Both the consumer and professional segments grew in double-digits in the second quarter. The government sector showed the slowest uptake, at 3 percent growth year-on-year. “This is in line with the austerity measures undertaken due to debt issues across Europe, which saw the German government freeze IT projects and cut IT spending,” said Ms. Escherich.

In the second quarter of 2010, Acer maintained its No. 1 position thanks to a strong performance in the consumer notebook market. HP struggled with product refreshment and overly aggressive pricing in the retail segment, and its volumes grew by less than the market average. Dell and ASUS shared third place. ASUS continued to perform well in the mini-notebook market, with sales of these products accounting for 36 percent of its total PC shipments. Dell grew its volumes for both notebooks and desktop PCs by more than 20 percent in the second quarter of 2010. Lenovo secured fifth place, ahead of Medion.

“PC prices have declined by 15 to 20 percent year-on-year for the last two years, but the second quarter of 2010 showed that such steep declines are no longer sustainable, due to an increase in bill-of-materials costs for PCs (screens, memory, etc.) and the appreciation of the dollar against the euro. The growth in demand from the professional segment during the quarter caused prices to go up, and we should expect PC prices to stabilize further,” said Ms. Escherich.