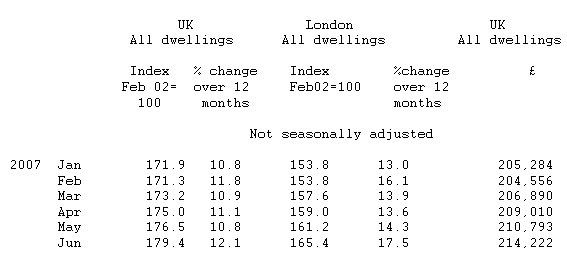

per cent in June, up from 14.3 per cent in May.

* The UK annual house price inflation rate for the 3 months to June was 11.3 per cent and 15.1 per cent in London.

HOUSE PRICE INFLATION: REGIONAL

The UK house price inflation rate rose from 10.8 per cent in May 2007 to 12.1 per cent in June 2007. Between May and June there was a rise of 1.6 per cent in the prices index of properties bought compared with a smaller rise of 0.4 per cent over the same period last year resulting in an increase in the inflation rate.

The rise in UK prices between May and June can be attributed to increases in average prices for flats (2.4 per cent), detached properties and bungalows (2.3 per cent each), semi-detached dwellings (1.1 per cent) and terraced houses (1.0 per cent).

Wales saw a decrease in inflation in June 2007. In Wales annual house price inflation fell from 8.5 per cent in May to 7.6 per cent in June. In Scotland the inflation rate stayed the same at 15.6 per cent in May and June. England and Northern Ireland saw house price inflation increases. In England annual house price inflation rose from 9.6 per cent in May to 11.0 per cent in June; In Northern Ireland annual house price inflation in June was 55.9 per cent compared with 53.0 per cent in May.

House price inflation rose in all nine of the English regions.

The highest inflation rate was in London (17.5 percent) followed by South East (10.7 per cent), East and Yorkshire and the Humber (9.6 respectively) and the South West (9.4 per cent). Inflation rates were lower in the North West (9.1 per cent), East Midlands (8.5 per cent) and the North East (8.1 per cent). The lowest inflation rate was in the West Midlands (7.0 per cent).

HOUSE PRICES: REGIONAL

Mix-adjusted average house prices in June were £221,370 in England, £165,119 in Wales, £160,363 in Scotland and £240,302 in Northern Ireland.

The English region with the highest average house price in June remains London at £332,009. The lowest average price was in the North East at £148,992.

Of the English regions, only the East, London, South East and the South West had average prices above the UK average.

HOUSE PRICE INFLATION: TYPE OF BUYER

The UK house price inflation rate for first time buyers rose from 11.3 per cent in May to 12.4 per cent in June. There was a rise of 1.5 per cent in the prices index between May and June in the properties bought by first time buyers compared with a smaller rise of 0.5 per cent over the same period last year.

The inflation rate for former owner occupiers rose from 10.5 per cent in

May to 11.9 per cent in June. There was a rise of 1.7 per cent in the prices index between May and June in the properties bought by former owner occupiers, compared with a smaller rise of 0.4 per cent over the same period last year.

The average price paid by first time buyers across the whole of the UK was £164,755 in June, while the average price paid by former owner occupiers was £238,490.