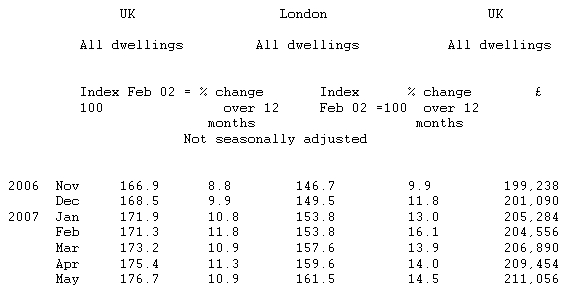

The UK house price inflation rate fell from 11.3 per cent in April 2007 to 10.9 per cent in May 2007. Between April and May there was a rise of 0.7 per cent in the prices index of properties bought compared with a larger rise of 1.1 per cent over the same period last year resulting in a decrease in the inflation rate.

The rise in UK prices between April and May can be attributed to increases in average prices for Flats (1.8 per cent), terraced houses (0.9 per cent), semi-detached dwellings (0.6 per cent), detached properties (0.3 per cent) and bungalows (0.1 per cent).

England, Scotland, Wales and Northern Ireland all saw decreases in inflation in May 2007. The inflation rate in England fell from 10.0 per cent in April to 9.8 in May; the inflation rate in Scotland fell from 17.8 per cent to 15.5; in Wales the rate fell from 9.0 per cent to 8.9 per cent and Northern Ireland the rate fell from 54.1 per cent to 51.9 percent.

House price inflation rose in three of the English regions, remained level in one region and fell in five regions.

The highest inflation rate was in London (14.5 percent) followed by South East (9.9 per cent), South West (9.4 per cent). Inflation rates were lower in Yorkshire and the Humber (9.3 per cent), East (8.8 per cent) and the North West (7.9 per cent). The lowest inflation rates were in the East Midlands (6.7 per cent), West Midlands (5.9 per cent) and the North East (5.8 per cent).

HOUSE PRICES: REGIONAL

Mix-adjusted average house prices in May were £218,225 in England, £163,852 in Wales, £157,974 in Scotland and £229,519 in Northern Ireland.

The English region with the highest average house price in May remains London at £324,084. The lowest average price was in the North East at £146,023.

Of the English regions, only the East, London, South East and the South West had average prices above the UK average.

HOUSE PRICE INFLATION: TYPE OF BUYER

The UK house price inflation rate for first time buyers remained unchanged at 11.2 in May. There was a rise of 1.3 per cent in the prices index between April and May in the properties bought by first time buyers compared with the same per cent rise over the same period last year.

The inflation rate for former owner occupiers fell from 11.3 per cent in April to 10.8 per cent in May. There was a rise of 0.6 per cent in the prices index between April and May in the properties bought by former owner occupiers, compared with a larger rise of 1.1 per cent over the same period last year.

The average price paid by first time buyers across the whole of the UK was £162,055 in May, while the average price paid by former owner occupiers was £235,095.