This year, the Commission’s report on the protection of the Communities’ financial interests and the fight against fraud highlights the topics of risk analysis and risk management, debarment databases and early-warning/whistleblower tools. The report analyses warning systems based on internal informers in the Member states and the European institutions who provide initial information that could trigger further investigations. At the other end of the investigative procedure, the report examines the steps taken to improve recovery of amounts not collected or wrongly paid, as well as the mechanisms for recovery by offsetting under national law. The report further contains information on the amounts recovered and the financial corrections undertaken, in particular when a payment was not made in conformity with Community rules.

Detailed figures by sector and country

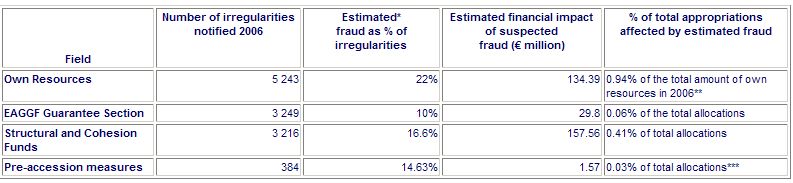

* The statistical annex of the report gives detailed figures by sector and by Member State. In the field of own resources, the number of cases of fraud and irregularities detected and reported (cases concerning more than EUR 10 000) was down 12% on 2005, but the amount affected by irregularities rose by over 7% (from €328 million to €353 million). The goods most affected by irregularities in 2006 are TVs and tobacco products and oils and fats and the most frequent origins are China, the US, Japan, Brazil and South Korea.

* For agricultural expenditure, the number of irregularities reported was up 3% on the previous year . The total amount involved in 2006 was 15% less, at €87million. The highest number of irregularities reported concerned the rural development sector, bovine sector, and fruit and vegetables. The estimated impact of fraud was roughly stable. Together these three groups accounted for almost 60% of the total number of reported irregularities and almost 70% of the total amount affected by irregularities.

* The number of irregularities reported in 2006 concerning structural measures (including the Cohesion Fund) was down 10% on the previous year whereas their financial impact increased by 17% to €703 million in 2006. As in previous years, the European Regional Development Fund and European Social Fund account for the most irregularities (around 75%). The estimated impact of fraud has declined compared to 2005.

* As regards the pre-accession funds, the number of irregularities increased by 13.6%. The presumed financial impact of the irregularities increased for PHARE and SAPARD but fell for ISPA (from €6.9 million in 2005 to €1.2 million in 2006). For 2006, the total amount of irregularities reported was down 26% to €12.318 million (from €16.7 million in 2005). The estimated impact of fraud has declined compared to 2005.

Results of the fight against fraud in 2006

* These estimates are based on information supplied by Member States concerning cases of suspected fraud (which have often not yet been established by a definitive judgment), and must be treated with caution.

** This percentage is calculated on the basis of an estimate of traditional own resources in the 2006 general budget, and not on the basis of accounts.

*** Percentage of suspected fraud during 2000-06 period for all funds allocated during the period.

Background

Community law requires Member States to notify the Commission of cases of fraud and other irregularities that are detrimental to financial interests in all areas of Community activity. However, the picture provided by the statistics is not necessarily complete, since the Commission depends on the communication of incidents by the Member States. It is important to distinguish between fraud and irregularities: fraud is defined as an irregularity committed intentionally, which constitutes a criminal act that only a court may define as such. The real financial impact of fraud can be measured only at the end of legal proceedings.