On 1 January 2009, there were 8,350 MFIs resident in the euro area, compared with 7,887 MFIs on 1 January 2008. In Ireland, 419 credit unions have been reclassified as credit institutions (and thus as MFIs). In Spain, 114 capital market mutual funds have been reclassified as money market asset mutual funds, which are considered money market funds (MMFs) for ECB purposes.

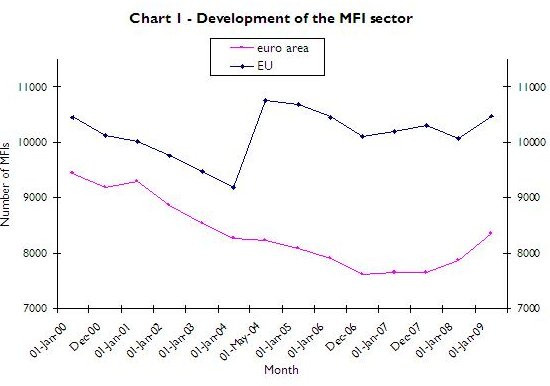

Despite the enlargement of the euro area through the accession of Greece (2001), Slovenia (2007), Cyprus and Malta (both 2008) as well as Slovakia (2009), the number of MFIs in the euro area has decreased by 15% or 1,506 institutions since 1 January 1999. Germany and France account for 41% of all euro area MFIs. The decreasing trend in the numbers of MFIs since the start of Stage Three of Economic and Monetary Union on 1 January 1999, is clearly visible in Chart 1 below.

On 1 January 2009, there were 10,476 MFIs resident in the EU, which implies a net increase of 408 units (4%) since 1 January 2008. Compared with the situation on 1 January 1999 (10,909 MFIs in the EU), there has been a net decrease of 433 units (4%), despite the addition of 1,608 MFIs on 1 May 2004, when ten new Member States acceded, and despite the addition of 72 MFIs on 1 January 2007, when Bulgaria and Romania joined the EU.

Structure of MFIs

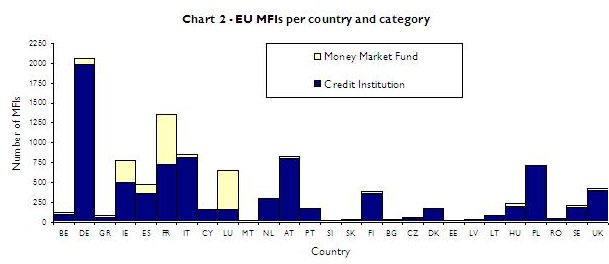

The vast majority of euro area MFIs consists of credit institutions (i.e. commercial banks, savings banks, post banks, credit unions, etc.), which accounted for 79% (6,596 units) on 1 January 2009, while money market funds contributed 20.8% (1,734 units). Central banks (17 units including the ECB) and other institutions (3 units) together only accounted for 0.2% of all euro area MFIs.

In the EU as a whole, the shares of credit institutions and money market funds were 81.4% and 17.8%, respectively (see Chart 2 below).

Country breakdown on 1 January 2009

In the euro area, two countries accounted for 40.9% of all MFIs, namely Germany (24.7%) and France (16.2%). Italy, Austria and Ireland accounted for a further 29.4%. Over the past decade (1999-2009), noteworthy developments in national MFI sectors include: a significant increase of 285 units in Ireland (mainly on account of the reclassification of credit unions as credit institutions) and, conversely, relatively large decreases in the Netherlands, Germany and France (by 53%, 37% and 30% respectively), and to a lesser extent in Spain, Portugal and Belgium (by 22%, 22% and 21% respectively). Since joining the EU on 1 May 2004, the MFI sectors in Malta and Slovakia have increased notably, by 71% and 43% respectively. The number of MFIs in Cyprus, by contrast, has decreased by 60% over the same period.

Among the non-euro area countries, Poland has by far the largest number of MFIs (716), representing 7% of the MFI sector in the EU. Since their accession to the EU, there have been substantial increases in the MFI sectors of Latvia (40%) and Estonia (36%). Sweden saw an increase of 42% in the number of MFIs from 1999 to 2004, after which a decreasing trend started. In the United Kingdom and Denmark, the MFI populations contracted by 23% and 19% respectively in the period from 1999 to 2009.

Foreign branches

On 1 January 2009, 638 branches of foreign credit institutions were resident in the euro area. These branches accounted for 9.6% of all euro area credit institutions. The largest share of these branches was located in Germany (18%), while Belgium had the largest proportion of foreign branches in relation to the total number of credit institutions (53%). For the majority of the foreign branches in euro area countries, the head offices were located either in another euro area country (64%) or in the United Kingdom (14%).

On 1 January 2009, there were 142 branches of foreign credit institutions resident in non-euro area EU countries. Of these, the largest percentage (43%) was located in the United Kingdom. Estonia had the largest proportion of foreign branches (60%), in relation to the total number of credit institutions in the country. The head offices of the majority of foreign branches in non-euro area EU countries were located either in euro area countries (66%) or in other non-euro area EU Member States (31%).