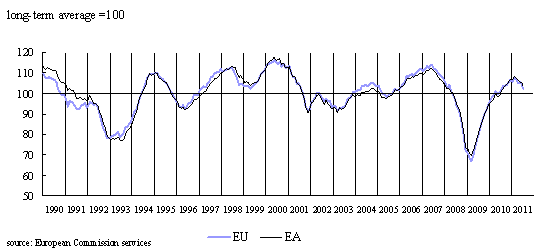

Economic sentiment indicator (s.a.)

EU: July 102.4

Euro area: July 103.2

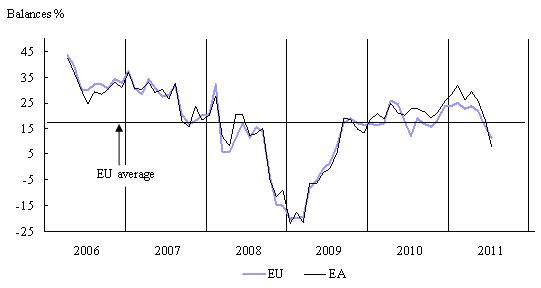

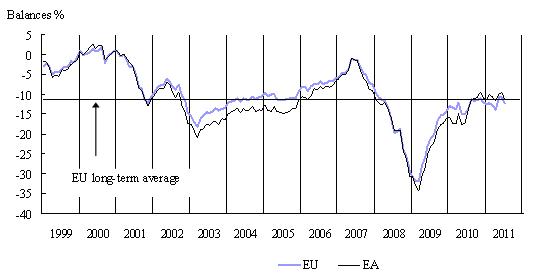

Although confidence remains firmly above its long-term average in industry in both the EU and the euro area, this sector contributed negatively to overall sentiment in both regions. Industrial confidence decreased by 2.6 points in the EU and by 2.4 points in the euro area, on the back of more cautious managers' production expectations and more pessimistic views about their overall order books. Past production declined markedly in both regions, while the assessment of stocks continued to improve from historic lows.

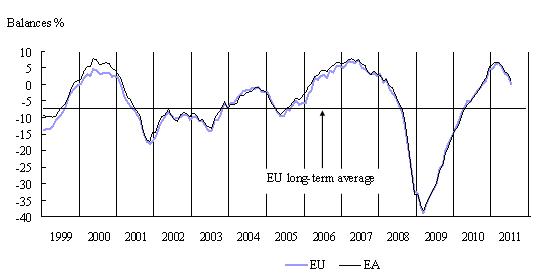

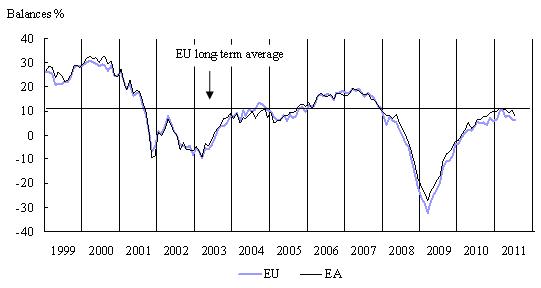

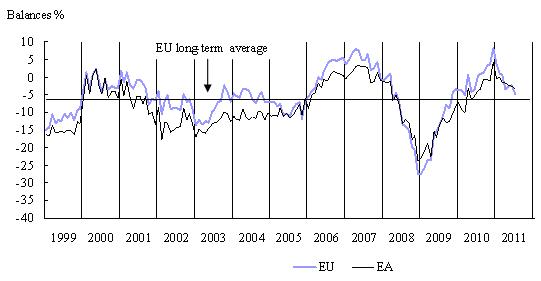

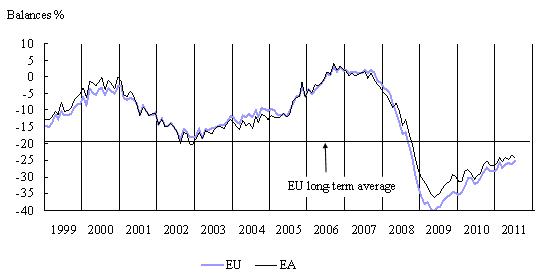

Sentiment in services decreased by 2.2 the euro area, but less so in the EU (-0.4). In both regions, managers showed concerns about both their past business situation and past demand developments, while expected future demand declined slightly. The worsening of sentiment in the retail sector was more pronounced in the EU (-2.6) than in the euro area (-0.9), as the UK reported losses in this sector. Also, confidence among consumers decreased in both regions (-1.5 in both the EU and the euro area), reflecting mainly increased pessimism about the future general economic situation and unemployment. Sentiment in construction decreased in the euro area (-1.0), while improving in the EU (+0.9). However, both indicators remain below their long-term average.

In the euro area employment expectations deteriorated in industry but improved in services. After the increase observed in the first quarter 2011, managers’ selling-price expectations in these two sectors continued to decline for the fourth consecutive month. Contrasting with managers' prospects, consumers’ price expectations increased moderately in the euro area in July.

Confidence in financial services – not included in the ESI – decreased by -4.6 in the EU and by -10.8 in the euro area. The deterioration in the euro area reflected a weaker assessment of all the underlying components.

In the quarterly survey of the manufacturing sector, carried out in July 2011, industrial managers in the EU and the euro area reported significantly weaker new orders and export volume expectations for the three months ahead. In both regions, managers' views on their competitive position on foreign markets outside the EU also deteriorated over the past three months.

Capacity utilisation declined in July in both the EU and the euro area, interrupting its two-year upward trend since the trough in July 2009. At 80.7% in the EU and 80.9% in the euro area, capacity utilisation slipped just below its long-term average. This aggregate picture masks a strong heterogeneity at the Member State level, with Germany remaining firmly well above its long-term average while peripheral countries are lagging behind.

Industrial confidence indicator (s.a.)

EU: July 0.3

Euro area: July 1.1

Service confidence indicator (s.a.)

EU: July 6.2

Euro area: July 7.9

Consumer confidence indicator (s.a.)

EU: July -12.4

Euro area: July -11.2

Retail trade confidence indicator (s.a.)

EU: July -5.0

Euro area: July -3.5

Construction confidence indicator (s.a.)

EU: July -25.2

Euro area: July -24.5

Financial services confidence indicator (n.s.a.)

EU: July 11.3

Euro area: July 7.5