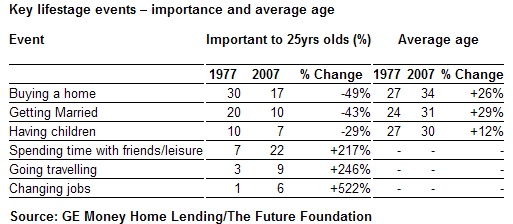

* Half as many 25-year olds see homeownership and marriage as important compared to 30 year ago, with socialising and friends now top priority

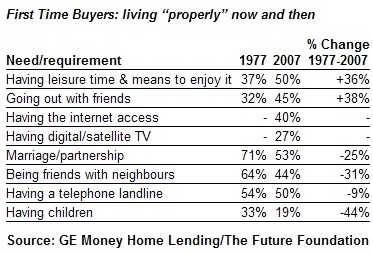

* Only half of first time buyers cite living with a partner as necessary to live properly in 2007 – down from almost three quarters in 1977 (71%)

* In 1977 being on friendly terms with the neighbours was essential for two thirds (64%) – in 2007 less than half see this as important

* Having satellite TV is 50% more important to First Time Buyers as having children, as desire to start a family almost halves to 19%

* A staggering 1,436% house price inflation over 30 years leads 76% of consumers to claim first time buyer affordability is worse than ever before

“The fact that taking the first step onto the property ladder now occurs later in life is due in no small part to economic factors such as house prices. However, our analysis also reveals that today’s potential younger buyers also have vastly different attitudes, aspirations and lifestyles to their counterparts 30 years ago. This refusal to conform to traditional family-oriented motivations and the desire to gain independence and experience, undoubtedly delays the purchase of a first home and contributes to the ongoing affordability issues faced by these consumers.” Gerry Bell, Head of Mortgage Marketing, GE Money Home Lending UK

A new report published by UK mortgage provider GE Money Home Lending, reveals the extent to which the profile of the average first time buyer has transformed over the past thirty years. The report, entitled “Life on Mars”, suggests that as well as the obvious economic factors, changing lifestyle choices are playing a significant part in delaying that crucial first step onto the property ladder, as well as contributing to the affordability stretch.

House prices and affordability: There has been a staggering 1,436% house price inflation since 1977, resulting in 76% of consumers claiming today is the worst time ever in terms of affordability for first time buyers. The average first time buyer now devotes almost a quarter of income to annual mortgage payments.

Changing lifestyle priorities: In 1977 the top priority for a 25-year old was buying a home and getting married. 30 years on, spending time with friends, leisure time and travel take over as the top priorities. Marriage and homeownership in 1977 have both halved in importance for the average 25 year old today, contributing to the significantly increased age of first time buyers, marriage and parenthood. These choices often make affordability more difficult in later life – as the pursuit of life experiences and leisure increases young people’s personal debt levels, whilst at the same time house prices continue to move out of reach for them.

Motivations for buying your first home: The psychology of buying the first home has shifted from one linked intrinsically with marriage, towards a choice to be independent and gain a sense of worth. In 1977 over half of first time buyers said their main motivation for buying resulted from their recent marriage, compared with just 14% in 2007. Conversely, more than half of first time buyers in 2007 said wanting a home that was their own was their main motivation for buying, compared with under a third in 1977.

The changing needs of first time buyers: There has been a significant change in what first time buyers now consider to be fundamentally important to “living properly” when buying their first home, with a clear move away from marriage and community to individual development, achievement and experiences.

In 1977 almost three quarters (71%) of first time buyers regarded living with a partner as an essential priority - by 2007 this falls to just over half. In addition, there has been a massive 44% decrease in those who claim that having a child is key to living happily - from 33% in 1977 to 19% today (satellite TV is seen as more essential). Perhaps the most revealing statistic is the fact that the number of first time buyers that regard being on friendly terms with neighbours as important has dwindled by almost a third.

How the first home is bought: The picture of who people buy their first house with has changed somewhat over the last 30 years. The proportion buying with their husband / wife has seen a huge decrease since 1977 from 80% to just a third today with some 28% of first time buyers in 2007 buying on their own – almost double the proportion that did in 1977. In addition a staggering 51% of all First Time Buyer now receive some form of financial support from parents or grandparents.

Gerry Bell continued: “This report has uncovered some key trends amongst contemporary first time buyers which highlight the challenges we now face with homeownership, compared with our parents 30-years ago. Affordability is clearly a major issue and an issue which is here to stay, as house prices continue to create the biggest challenge for future first time buyers.

“However what has to be acknowledged is the fact that younger people are increasingly choosing to reject the more traditional path of family and community and choosing independent living and experience. As this report highlights there are consequences to this – such as affordability challenges and increasingly older first time buyers and families.

“What the research undoubtedly illustrates, however, is that the UK is a diverse and rapidly changing market which will continue to pose challenges for buyers – particularly those seeking to buy their first home.”