Sentiment in services rose significantly in both the EU (+3.6) and the euro area (+1.2). Managers were especially upbeat about the evolution of demand observed in the past months, while they were more cautious about expected demand. Sentiment in construction increased significantly as well, both in the EU and the euro area (+2.1 and +1.7, respectively), although the indicator remains at very low levels in both regions. Sentiment in the retail sector weakened substantially in the EU (-2.8) and improved marginally in the euro area (+0.4). Confidence among consumers improved significantly in the euro area (+1.2), while it remained stable in the EU, mainly because of a deterioration in UK consumers' assessment of the general economic situation and unemployment fears.

In both regions, managers in industry and services signalled a significant increase in their selling price expectations, while households also reported a rise in their assessment of past and future price trends.

Confidence in financial services – not included in the ESI – improved significantly in both the EU (+1.2) and the euro area (+3.8), mainly backed by improved demand expectations.

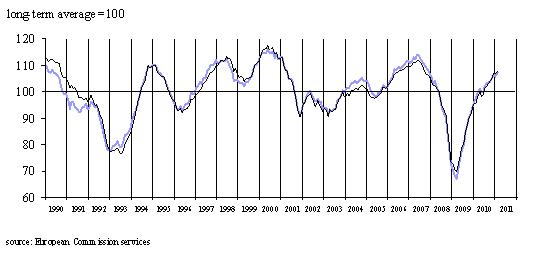

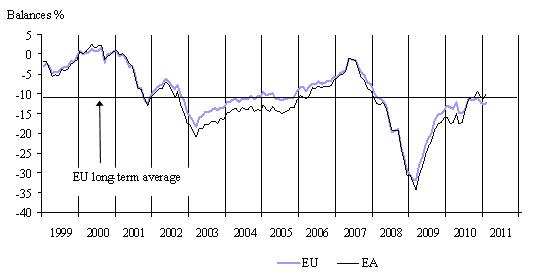

Economic sentiment indicator (s.a.)

EU: February 107.2

Euro area: February 107.8

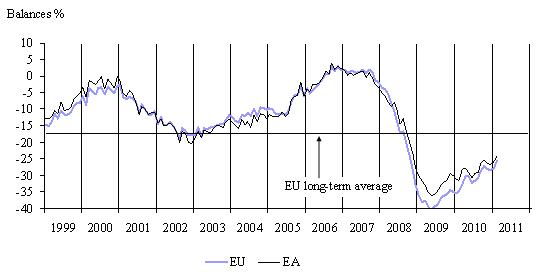

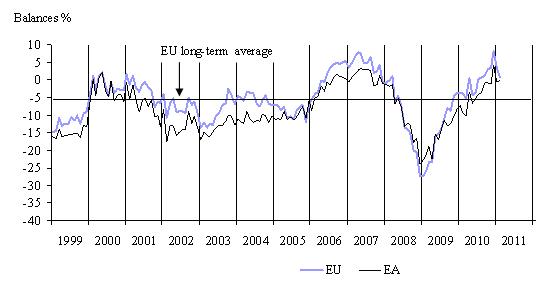

Industrial confidence indicator (s.a.)

EU: February 5.9

Euro area: February 6.5

Service confidence indicator (s.a.)

EU: February 9.7

Euro area: February 11.1

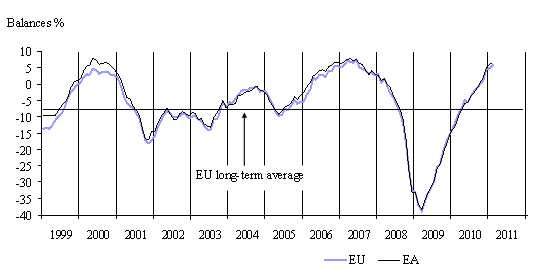

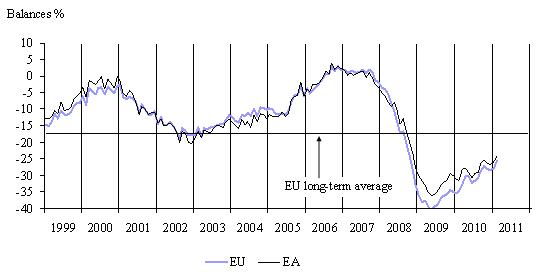

Consumer confidence indicator (s.a.)

EU: February -12.4

Euro area: February -10

Retail trade confidence indicator (s.a.)

EU: February 0.8

Euro area: February -0.2

Construction confidence indicator (s.a.)

EU: February -25.8

Euro area: February -24.3

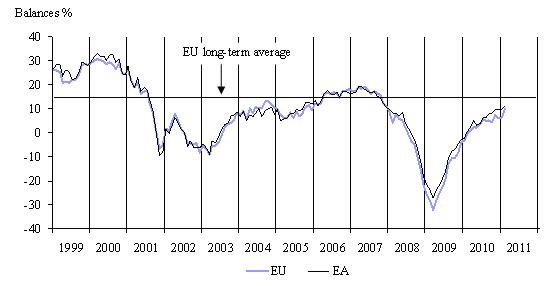

Financial services confidence indicator (n.s.a.)

EU: February 24.8

Euro area: February 31.8