The working day and seasonally adjusted (and the non-adjusted) current account of the euro area was balanced in November 2009. This reflected surpluses in goods (EUR 7.0 billion) and services (EUR 2.3 billion), which were offset by deficits in current transfers (EUR 5.8 billion) and income (EUR 3.3 billion).

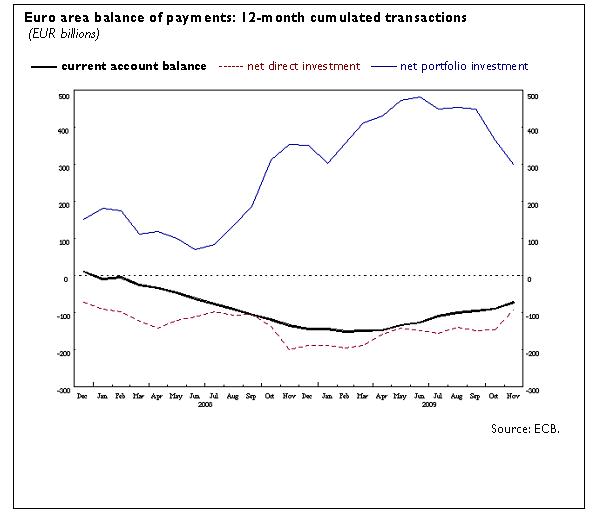

The 12-month cumulated, working day-adjusted current account recorded a deficit of EUR 73.5 billion (around 0.8% of euro area GDP) in November 2009, compared with a deficit of EUR 136.1 billion a year earlier. The decrease in the current account deficit was mainly accounted for by a shift in goods from a deficit (EUR 12.5 billion) to a surplus (EUR 29.9 billion), decreases in the deficits in income (from EUR 67.2 billion to EUR 38.1 billion) and to a lesser extent in current transfers (from EUR 97.1 billion to EUR 95.1 billion). Conversely, the surplus in services decreased (from EUR 40.7 billion to EUR 29.9 billion).

Financial account

In the non-seasonally adjusted financial account, combined direct and portfolio investment recorded net outflows in November 2009 (EUR 15 billion), resulting from outflows recorded in portfolio investment (EUR 15 billion).

The direct investment account was balanced as net outflows in equity capital and reinvested earnings (EUR 2 billion) were offset by net inflows in other capital (mostly inter-company loans) (EUR 1 billion).

The net outflows in portfolio investment were accounted for by net outflows in both equity (EUR 10 billion) and debt instruments (EUR 5 billion). The developments in portfolio investment mainly concerned net purchases of foreign equity by euro area residents (EUR 9 billion), and net sales by non-residents of euro area debt instruments (EUR 4 billion).

Financial derivatives recorded net outflows of EUR 1 billion.

Other investment recorded net inflows of EUR 15 billion, reflecting net inflows in other sectors (EUR 20 billion), which were partly offset by net outflows for general government (EUR 3 billion) and the Eurosystem (EUR 2 billion).

The Eurosystem’s stock of reserve assets increased from EUR 438 billion to EUR 464 billion in November 2009, mainly due to the increase in the gold market price. Transactions in reserve assets were balanced (excluding valuation effects).

In the 12-month period to November 2009, combined direct and portfolio investment recorded cumulated net inflows of EUR 207 billion, compared with net inflows of EUR 152 billion in the preceding 12-month period. This increase was mainly the result of lower net outflows in direct investment (down from EUR 200 billion to EUR 92 billion), which were partially offset by lower net inflows in portfolio investment (down from EUR 353 billion to EUR 300 billion). The developments in direct investment were characterised by a reduction of euro area net investment in foreign affiliates, as well as an increase of foreign investment in euro area companies.